Find the Best statutory health insurance in Germany

Are you looking for the best health insurance in Germany? At Neodirect - an insurance broker, we specialize in helping you find the perfect coverage that meets your unique needs. Our fully digital application process, policy management, and English support ensure a seamless experience. You can get a free quote now and determine which health insurance is best for you. Check statutory health insurance or private health insurance in Germany.

.png)

I am Martin B. Grödl

Since 1993, I have been guiding clients in transitioning to private health insurance.

If you are considering the benefits of personal medical care and are motivated by more than the potential savings, you've come to the right place.

I advise employees to achieve optimal coverage now and in the future. Let's take a page from the old Adenauer book and carefully compare the advantages and disadvantages of both systems.

Together, we can make an informed decision that offers the best prospects for the future.

%20(2).png?width=276&height=92&name=Orange%20and%20White%20Play%20Button%20DJ%20Charles%20%26%20Courbis%20Logo%20(500%20%C3%97%20100%20px)%20(2).png)

Discover the Benefits of Private Health Insurance

Why settle for anything less than the best? Our private health insurance plans offer unparalleled flexibility and coverage options to suit your unique lifestyle. Enjoy comprehensive benefits that go beyond what public health insurance provides, including dental and vision care. Ready to make the switch? We'll guide you through the process.

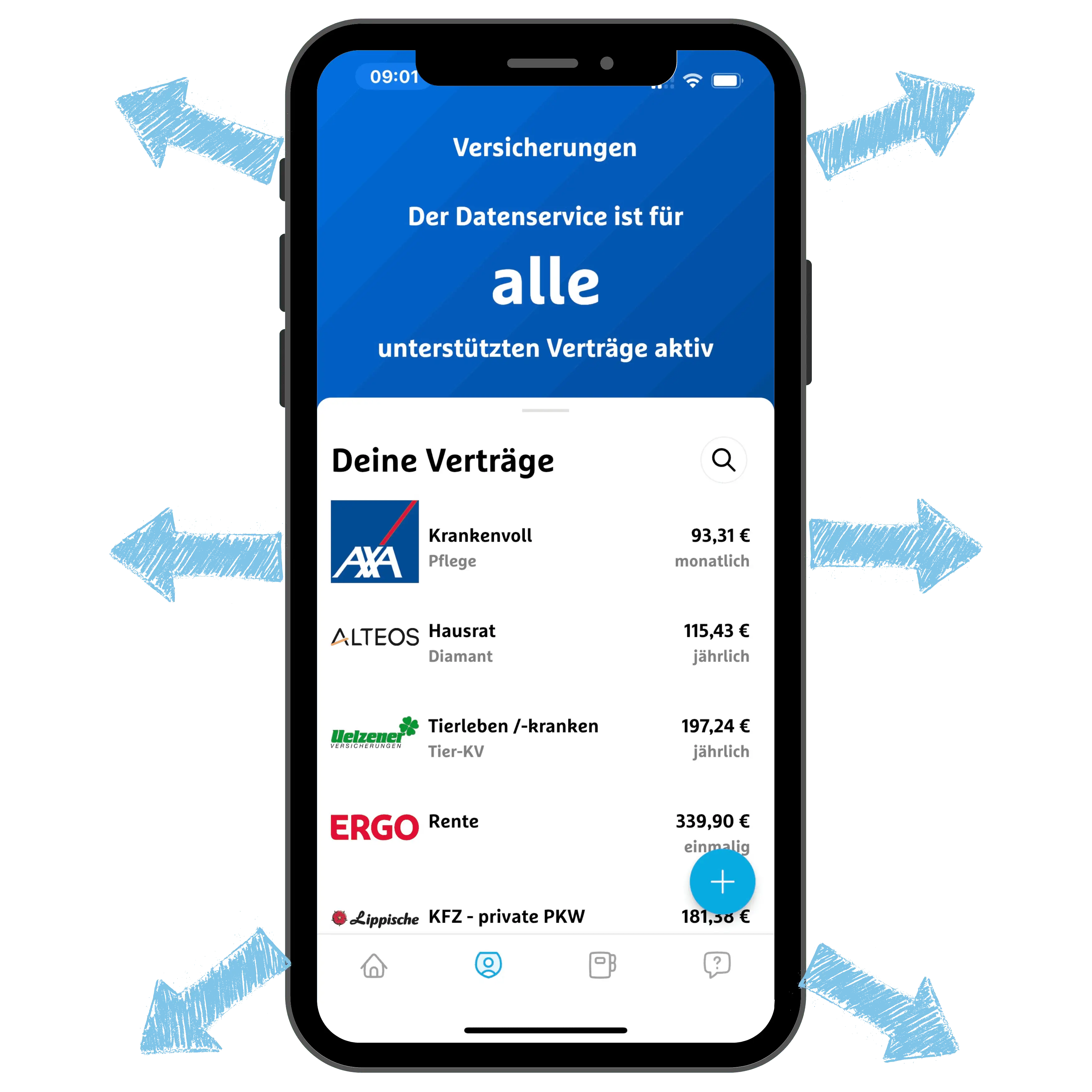

All-in-One Account Management

Simplify your insurance experience by managing multiple policies in one account. Access all your policies conveniently in a single place, from health and liability insurance to household and more.

Don't Just Take Our Word for It

OUR CUSTOMER SATISFACTION SPEAKS FOR ITSELF. READ WHAT THEY SAY ABOUT OUR TIMELY AND RESPONSIVE SUPPORT IN NAVIGATING THE GERMAN INSURANCE SYSTEM. WE STRIVE TO PROVIDE THE BEST SOLUTIONS TO EVERY CHALLENGE YOU MAY FACE.

Effortless Application Process

Getting your personal quote and coverage details is just a click away. Our online platform allows you to complete the application process within minutes. Our experts can support you through video calls or email if you need assistance.

Fast Track to Quality Healthcare

Gain access to exclusive appointment slots with general practitioners and specialist doctors, ensuring faster healthcare services. Private insurance allows you to experience shorter waiting times and prioritize your well-being.

Explore our Plans and Pricing

Tell us a little bit about yourself, and let our user-friendly calculator guide you towards the perfect plan. Simply provide us with your yearly income, age, occupation, and EU/EEA passport status, and we'll present you with a range of coverage options tailored to meet your unique needs and budget. Starting from just €200 per month, our plans offer comprehensive protection and peace of mind. Discover the ideal plan for you and take the first step towards securing your financial future today.

Tailor-Made Coverage for You

We understand that everyone's healthcare needs are unique. That's why we offer a range of coverage options and add-ons. You can customize your plan to make sure it aligns perfectly with your requirements.

_2.webp)

_2.webp)

_2.webp)

_2.webp)

_2.webp)

_2.webp)

_2.webp)

Send request

Individual advice

Offer received

Testimonials - See Why We're the Best

Don't just take our word for it.

Our satisfied customers rave about our timely and responsive support. Discover how we have helped them navigate the complexities of the German insurance system. At Neodirect, we are committed to providing you with the best solutions for your healthcare needs.

Do you have any questions?

Your Health, Your Priority

At Neodirect, we prioritize your well-being: experience customized coverage, faster appointments, and seamless support. Get a quote today and embark on a journey to comprehensive health insurance coverage.

If I switch to private health insurance, will I not be able to come back?

On the one hand, there is the question of why one would want to return to compulsory health insurance since the price is much higher and coverage will be further limited. However, some possibilities exist to steer the income below the mandatory insurance limit and then be compulsorily insured again. This should always be done with an expert who will monitor all the essential points.

Can I save money with private health insurance?

Private health insurance is often cheaper than statutory health insurance because the change also only makes sense for people with a very high income in the long term.

I recommend never switching to private health insurance to save money but always paying the highest possible contribution to the employer to finance future contributions. A favorable donation is usually only an advantage for the employer, not the employee.

If I start a family, then it will be too expensive?

If family planning leads to a financial bottleneck, then the fundamental question is whether to switch back to statutory health insurance by drawing parental allowance. Since pediatricians often only treat private patients in many large cities, it can make sense to remain in private health insurance. A contribution of 150-200€ per child per month is to be planned.

I don't want to switch to private health insurance and prefer to remain insured by law?

If you can theoretically switch to private health insurance, then the question of whether you should take out personal insurance does not usually arise. With an income of over 60,000 €, there are, in any case, gaps in the area of coverage in the event of incapacity for work (AU) and then in the area of occupational disability (BU). Therefore, I would never ask whether PKV or GKV, but always the question only private health insurance or statutory health insurance combined with private supplementary insurance.

In old age, private health insurance is no longer affordable.

In my 30 years as a consultant on private health insurance, it has very rarely come to this reality. However, from 2008 -2014, tariffs were often sold that needed to be calculated sustainably and were marketed to customers at dumping prices without being sustainable. Here my motto applies again, never change because of the cost of cheap tariffs to save money you do not have. PKV is reasonable and affordable for people with high incomes, but with money, the car is excellent and affordable at the beginning and even less so in old age.

I have heard that the father/mother of an acquaintance can not pay the PKV in old age.

I know these incidents and could only usually determine that it was often not because of the high contribution, but because of the non-existent retirement provision. Especially with self-employed people, there is often the problem that no provision is made for old age and then comes the rude awakening at retirement age. Here, it is rarely the private health insurance that is the problem, but the desolate old-age provision.