Why Indians Trust Neodirect

English-Speaking Experts

We explain everything in your language – clearly and patiently.

100% Independent

We work for you – not for the insurance companies.

Completely Free

You never pay us – we're paid by the insurer if you sign up.

Why Our Indian Clients Recommend Neodirect

How It Works

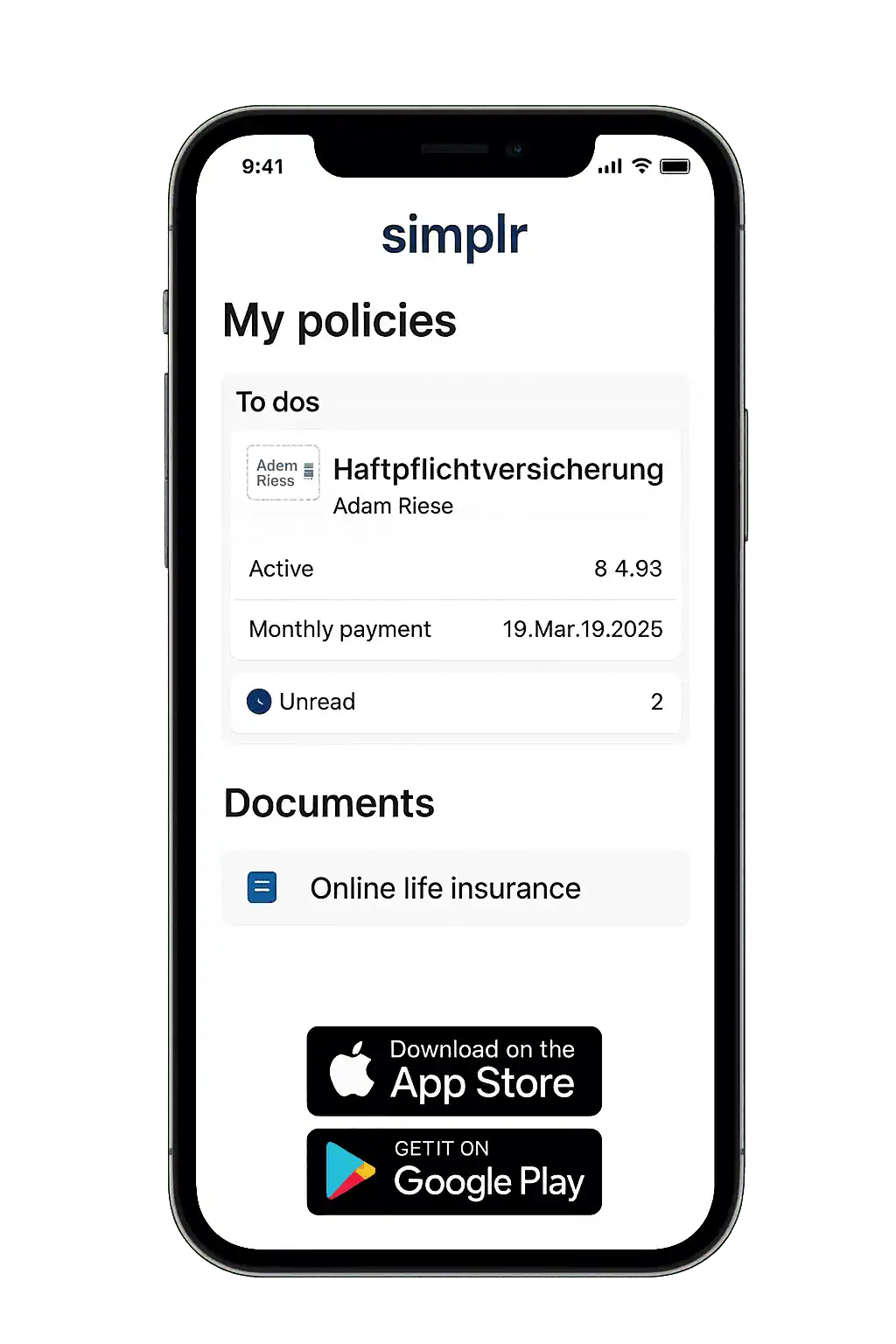

Manage Your Insurance with the simplr App

Access all your policies anytime. Submit claims, get updates, and store documents – all in English, all in one app.

🎁 Bonus: Get up to €25 Amazon voucher when you use the app!

5.0 (25) ⭐⭐⭐⭐⭐ GOOGLE